Le portefeuille “All Weather” de Ray Dalio

All Weather, a Bridgewater fund that is designed to follow markets more closely, rose 10.6% last year, the person added.. Bridgewater, whose founder Ray Dalio is co-chair and co-chief.

Ray Dalio All Weather Portfolio Strategy With ETF 2020 YouTube

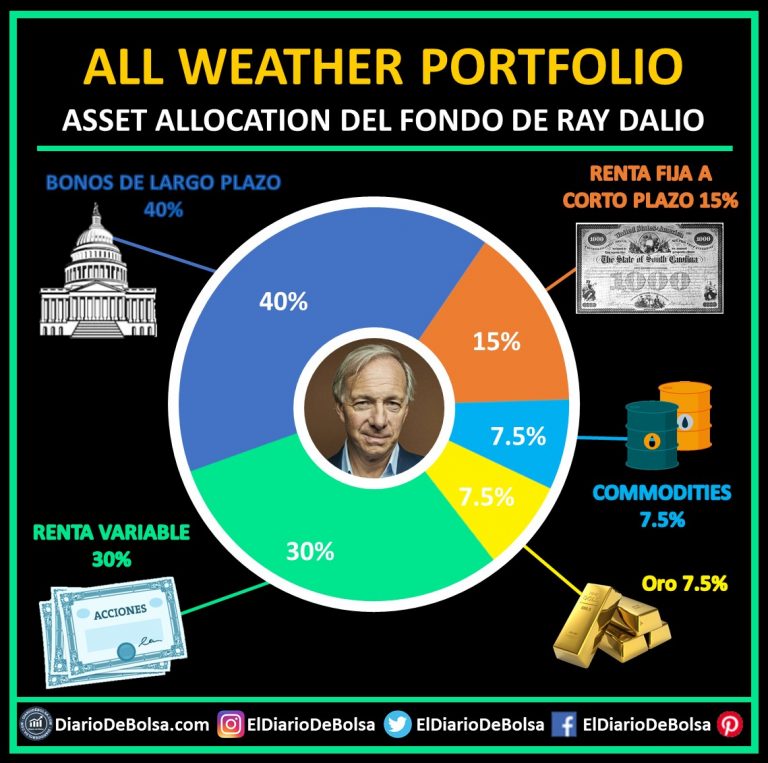

The All Weather Portfolio is a concept pioneered by Ray Dalio, the founder of the world's largest hedge fund, Bridgewater Associates. This portfolio aims to perform well across all economic conditions - be it growth, inflation, deflation, or recession.

Ray Dalio costruire il portafoglio All Weather (All Season)

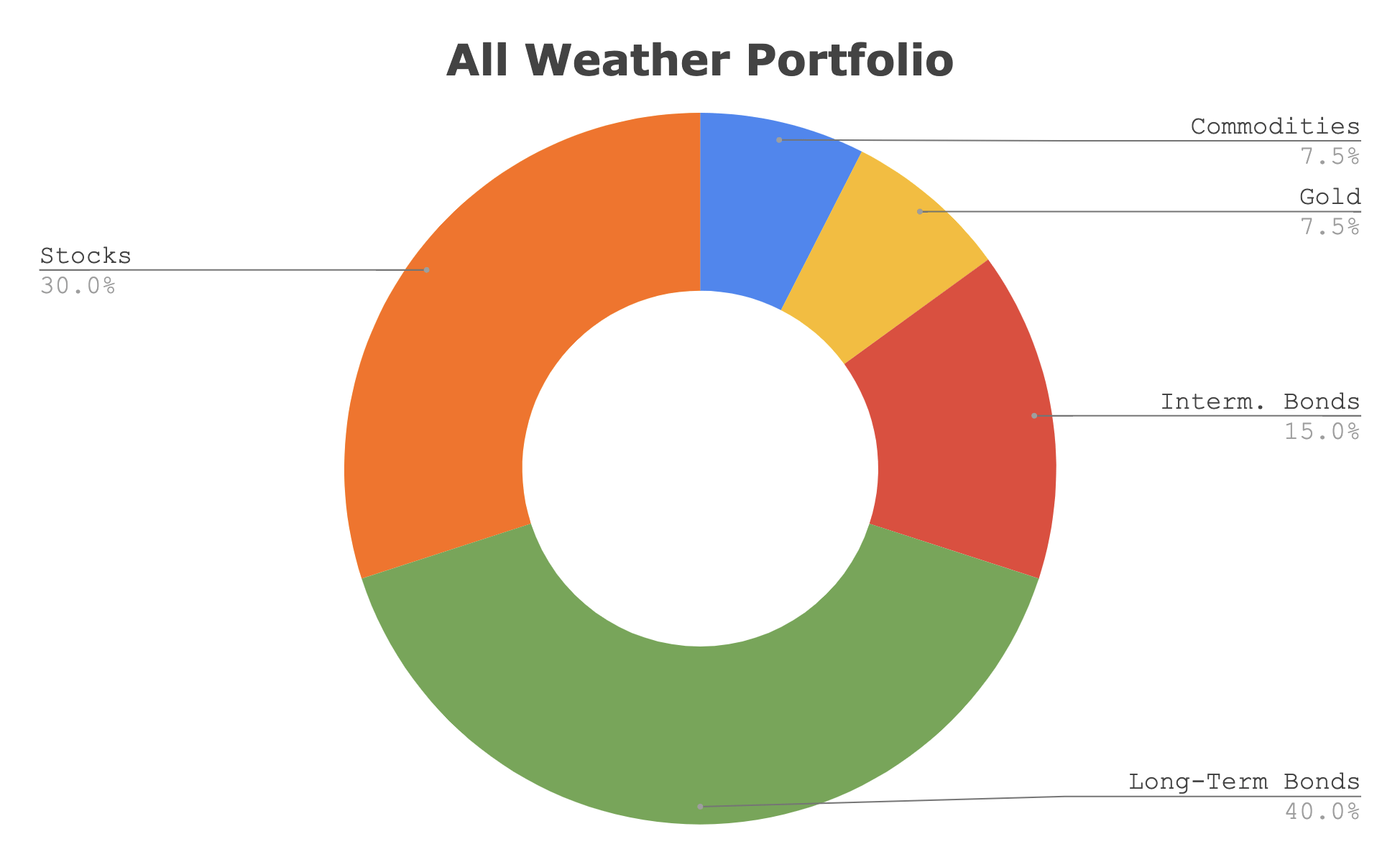

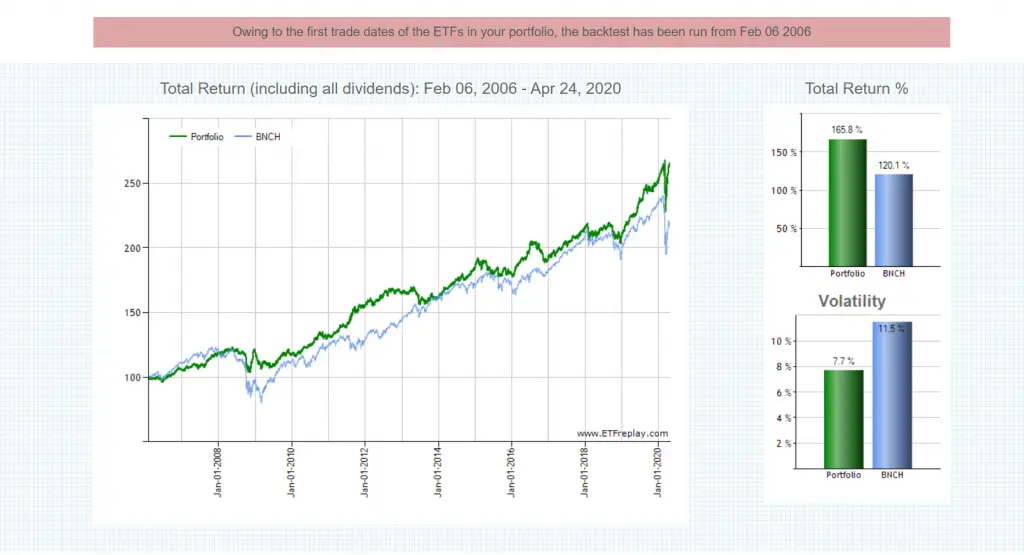

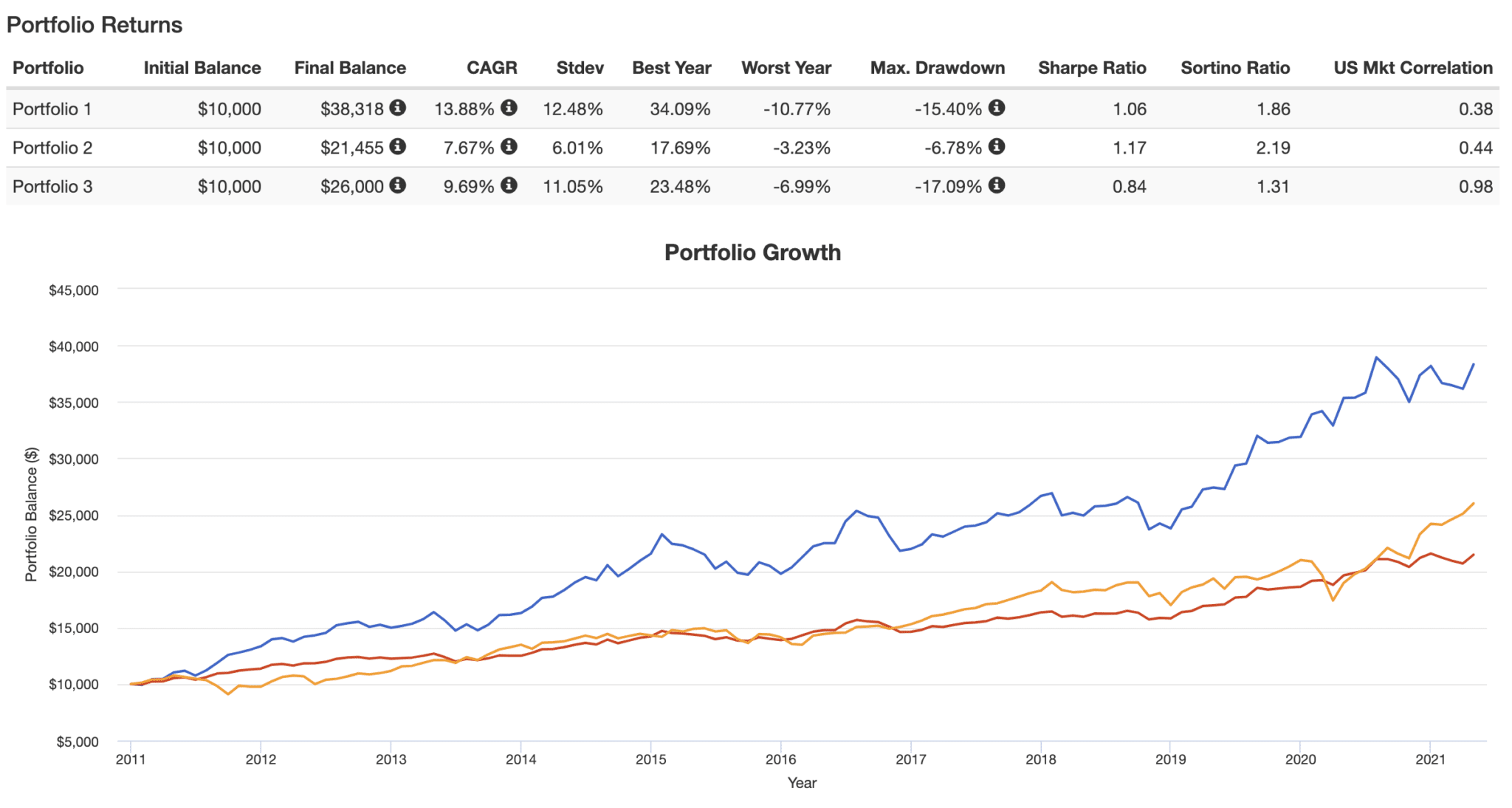

The All Weather Portfolio is a well-diversified, low-risk portfolio from Ray Dalio designed to "weather" any environment. Here we'll look at the All Weather Portfolio's components, historical performance, ETFs to use in 2023, and various leveraged strategies. Interested in more Lazy Portfolios? See the full list here.

Rookie Review Of Ray Dalios' "All Weather Portfolio"

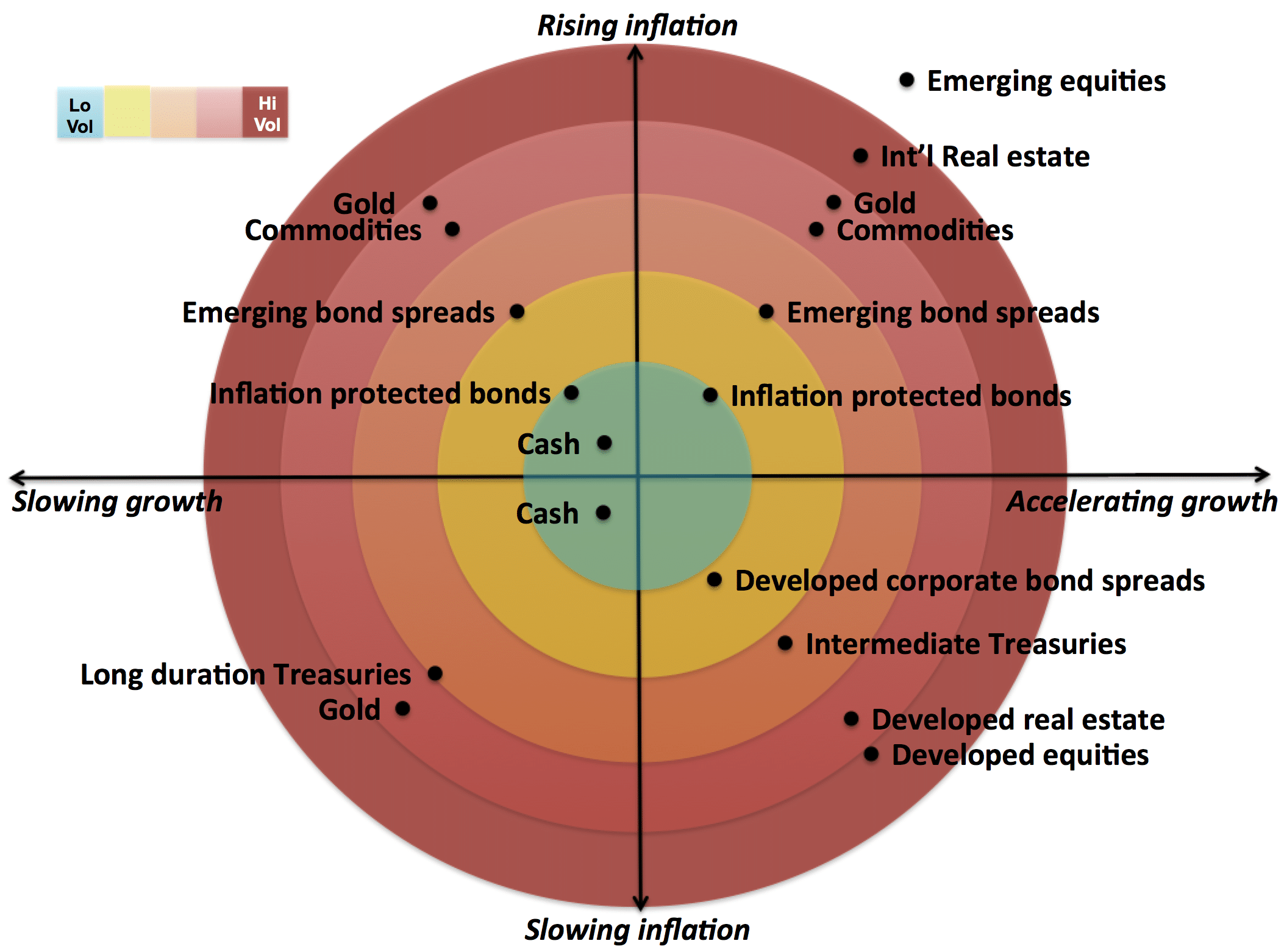

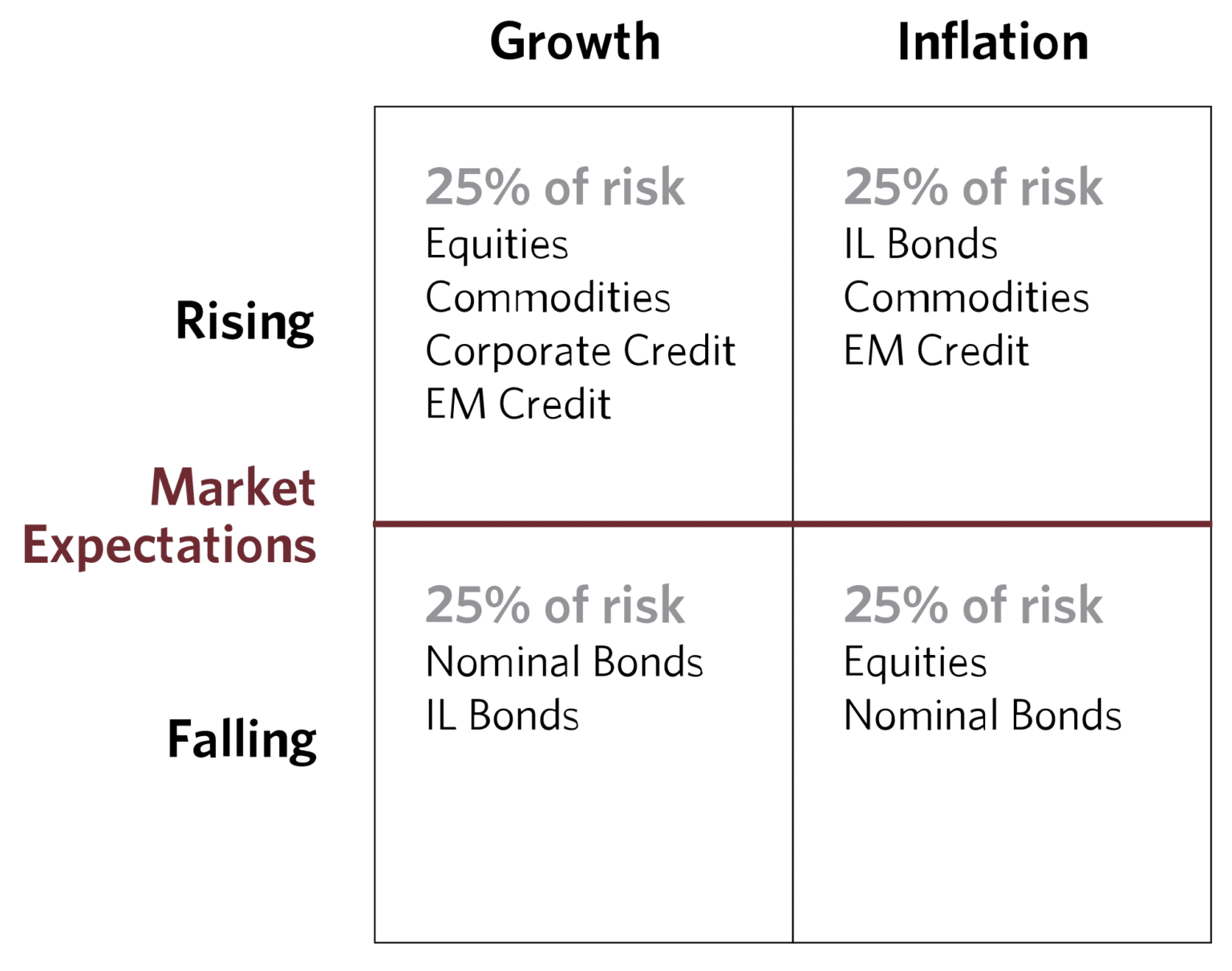

What is an All Weather Portfolio? Ray Dalio is known for his investment philosophy and approach to financial management. They are based on the principles of diversification and risk management, as well as forecasting economic cycles.

Ray Dalio All Weather Portfolio Review, ETF's, & Leverage

Ray Dalio's "All Weather" portfolio is designed to work in all economic situations, whether we're in a period of high growth or in a recession. It has rightfully become a popular portfolio for investors seeking a good return on the long term, while offering more stability. But how do you build it using ETFs?

Ray Dalio All Weather Portfolio Guide to Asset Allocations, Pros

The Ray Dalio All Weather Portfolio is a Medium Risk portfolio and can be implemented with 5 ETFs. It's exposed for 30% on the Stock Market and for 15% on Commodities. In the last 30 Years, the Ray Dalio All Weather Portfolio obtained a 7.33% compound annual return, with a 7.43% standard deviation. Table of contents Asset Allocation and ETFs

Ray Dalio Thrives In Stock Market Crashes. Here’s His AllWeather

Data Source: from January 1871 to November 2023 (~153 years) Consolidated Returns as of 30 November 2023. Holding the Ray Dalio All Weather Portfolio, how long should you stay invested to have high probability to obtain a positive return? Considering all the available data source (~153 years), the longest period with a negative return lasted 84.

Ray Dalio All Weather Portfolio

Ray Dalio's All-Weather portfolio is an investment strategy based on the principles of risk parity and diversification across geographies, currencies and asset classes. It is a portfolio designed to perform well in various market conditions.

The Ray Dalio All Weather Portfolio New Trader U

Pros & Cons of the Ray Dalio All Weather Portfolio. In the final analysis, the Rad Dalio All Weather Portfolio has several pros and cons: Easy to implement with ETFs. Volatility lower than a "traditional" portfolio. Sharpe and Sortino ratios higher than a "traditional" portfolio. May underperform a 3-fund portfolio unless leverage is used.

YouTube

One of Dalio's portfolio models is the All-Weather portfolio. A well-diversified low-risk investment strategy crafted to thrive in all economic conditions, growth or decline, inflation, or.

Investing Strategies Ray Dalio's All weather Portfolio YouTube

It's a defensive portfolio. Both during the financial crisis in 2008/09, Covid-19 in 2020, and the bear market of 2022 it performed better than stocks. We show you how you can construct an All-Weather Portfolio and how you can backtest it. Let's get started: Table of contents: Who is Ray Dalio? What is the All Weather Portfolio?

How to recreate Ray Dalio’s AllWeather portfolio only using ETFs mix

Tony Robbins: Ray Dalio's "All Weather" Portfolio Advertisement Nasdaq (+0.09%) Russell 2000 1,951.14 -6.58 (-0.34%) Crude Oil 73.95 +1.76 (+2.44%) Gold 2,052.60 +2.60 (+0.13%) Silver.

Ray Dalio's all weather portfolio! Even if you disagree with his idea

Feedback Try though we might, human beings can't always accurately predict the weather. Dark, misty mornings can precede warm sunny days just as a tropical storm can emerge seemingly out of.

Ray Dalio All Weather Portfolio

The All Weather Portfolio is a long-term investment strategy developed by Ray Dalio, founder of Bridgewater Associates, one of the largest and most successful hedge funds in the world. The strategy is based on the principle of diversification and is designed to perform well in various market conditions, hence its name "All Weather Portfolio."

The Ray Dalio ALL WEATHER PORTFOLIO / What you NEED To Know! Ray

The All Weather Portfolio was created by Ray Dalio and his firm Bridgewater Associates, currently the largest hedge fund in the world. Bridgewater manages over $150 billion in assets and is known for their analysis of economic cycles as one of the top global macro hedge funds on Earth.

Qué es el All Weather Portfolio de Ray Dalio Diario de Bolsa

Watch on Here are 10 ways investors can improve the Ray Dalio All Weather Portfolio by going global, using leverage and adding uncorrelated assets.